Reader - Recommended Posts

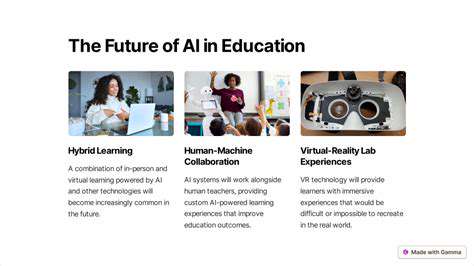

Hybrid Learning for Equity: Ensuring Access for All Students

Hybrid Learning for Equity: Ensuring Access for All Students

AI in the Classroom: Revolutionizing Teaching and Learning Processes

AI in the Classroom: Revolutionizing Teaching and Learning Processes

Gamification for Civic Engagement in Education

Gamification for Civic Engagement in Education

Engaging the Digital Native: Mobile Learning Strategies

Engaging the Digital Native: Mobile Learning Strategies

From Virtual Labs to Flight Simulators: Immersive Training for All

From Virtual Labs to Flight Simulators: Immersive Training for All

Future of Libraries: EdTech Integration and Community Hubs

Future of Libraries: EdTech Integration and Community Hubs

Engaging Parents and Guardians in Hybrid Learning Journeys

Engaging Parents and Guardians in Hybrid Learning Journeys

Building a Culture of Mastery Through Personalization

Building a Culture of Mastery Through Personalization

EdTech and the Future of STEAM Education

EdTech and the Future of STEAM Education

From Cultural Immersion to Scientific Discovery: Immersive Learning

From Cultural Immersion to Scientific Discovery: Immersive Learning

Personalized Learning for Government and Public Sector Training

Personalized Learning for Government and Public Sector Training

Offline Mobile Learning: Bridging the Digital Divide

Offline Mobile Learning: Bridging the Digital Divide

AI Powered Learning Platforms: The Next Generation of EdTech

AI Powered Learning Platforms: The Next Generation of EdTech

Measuring Cognitive Outcomes in Personalized Learning Environments

Measuring Cognitive Outcomes in Personalized Learning Environments

Personalized Feedback for Developing Growth Mindsets

Personalized Feedback for Developing Growth Mindsets

Mobile First Microlearning: Engaging and Effective

Mobile First Microlearning: Engaging and Effective

The Evolution of Learning Analytics: Predictive and Prescriptive

The Evolution of Learning Analytics: Predictive and Prescriptive

AR/VR for Special Needs Education: Tailored Immersive Experiences

AR/VR for Special Needs Education: Tailored Immersive Experiences

AI for Personalized Learning Analytics: Deeper Insights into Student Needs

AI for Personalized Learning Analytics: Deeper Insights into Student Needs

The Economic Benefits of Immersive Learning for Small Businesses

The Economic Benefits of Immersive Learning for Small Businesses

Preparing Students for AI: Essential Skills for the Future Workforce

Preparing Students for AI: Essential Skills for the Future Workforce

Affordable AR/VR Solutions for Every Educational Budget

Affordable AR/VR Solutions for Every Educational Budget

Student Driven Personalized Learning: Empowerment in Action

Student Driven Personalized Learning: Empowerment in Action

The Future of Interactive Textbooks: AI Powered and Adaptive

The Future of Interactive Textbooks: AI Powered and Adaptive

From Concept to Classroom: Piloting New EdTech Tools

From Concept to Classroom: Piloting New EdTech Tools

From Reactive to Proactive: Strategic Planning for Hybrid Learning

From Reactive to Proactive: Strategic Planning for Hybrid Learning

The Teacher as Curator in Personalized Learning Settings

The Teacher as Curator in Personalized Learning Settings

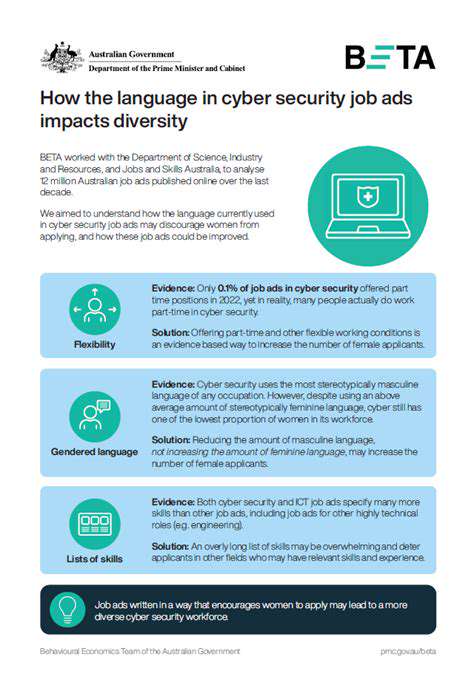

Mobile Learning for Cybersecurity Awareness

Mobile Learning for Cybersecurity Awareness

The Economic Impact of Immersive Learning for Non Profits

The Economic Impact of Immersive Learning for Non Profits

Professional Development for Hybrid Teaching Excellence: Ongoing Support

Professional Development for Hybrid Teaching Excellence: Ongoing Support