Funding EdTech Innovation: Opportunities for Startups and Schools

Understanding the Funding Landscape

The current funding landscape is complex and ever-evolving, with various sources and criteria impacting investment decisions. Navigating these intricacies is crucial for startups and established companies alike. Understanding the specific needs and expectations of different investors is paramount for successful fundraising. This includes recognizing the varying risk appetites and investment horizons of venture capitalists, angel investors, and other potential funding partners.

Thorough research and a clear articulation of the business model, target market, and financial projections are essential components of a compelling funding proposal. Failing to adequately address these aspects can significantly hinder the chances of securing the necessary capital. This process requires a deep understanding of the market and the ability to effectively communicate the value proposition to potential investors.

Defining Funding Objectives

Before embarking on a fundraising campaign, it's essential to clearly define specific funding objectives. This involves outlining the amount of capital required, the intended use of funds, and the desired outcome. Precisely outlining these objectives will guide the fundraising strategy and ensure alignment with the overall business goals. This clarity will also allow for more effective communication with potential investors and help them understand the project's financial needs and potential return on investment.

Considering different funding stages and their respective requirements is equally important. Seed funding, Series A funding, and later-stage financing all have unique characteristics and expectations. Understanding these nuances is crucial for tailoring a compelling pitch that resonates with the target investor group.

Identifying Potential Investors

Identifying the right investors is a critical step in the fundraising process. It's not about simply targeting any investor, but rather focusing on those whose investment philosophy aligns with the company's vision and values. Analyzing the investment portfolios and track records of potential investors can provide valuable insights into their areas of expertise and preferred investment strategies.

Networking and building relationships with potential investors are equally important. Attending industry events, participating in online forums, and reaching out to individuals through personal connections can create valuable opportunities for introductions and initial discussions. These connections can be crucial in securing funding and potentially leading to fruitful collaborations.

Developing a Compelling Funding Proposal

Crafting a compelling funding proposal is crucial for showcasing the value proposition of the project and securing investment. This proposal should be concise, well-structured, and effectively communicate the key aspects of the business, including the market opportunity, competitive advantages, and financial projections. A clear and concise summary of the business plan is essential for capturing the investor's attention quickly.

Structuring the Fundraising Strategy

A well-defined fundraising strategy is essential for maximizing the chances of success. This strategy should outline specific steps, timelines, and key performance indicators (KPIs) to track progress. This includes creating a detailed timeline for investor outreach, presentations, and negotiations. A meticulous approach is key to a smooth and effective fundraising process.

Utilizing various communication channels, such as online platforms, investor conferences, and direct outreach, is essential for reaching a wider audience of potential investors. Adapting the pitch to different investor types and tailoring the message to their specific interests will enhance engagement and increase the likelihood of securing funding.

Managing the Funding Process

Effectively managing the funding process is crucial for successful fundraising. This includes meticulous record-keeping, timely responses to investor inquiries, and transparent communication throughout the process. Maintaining a professional and organized approach throughout the process is essential for building trust and confidence with potential investors. This often involves dedicated resources and processes to manage investor interactions and due diligence effectively.

Post-funding, maintaining open communication and adhering to agreements are crucial. Building a strong relationship with investors is essential for future collaborations and potential follow-up funding opportunities.

Leveraging Private Investment: Venture Capital and Angel Investors for EdTech

Private Investment Strategies for Venture Capital

Venture capital firms often leverage private investment strategies to identify and fund promising startups. These strategies encompass a wide range of approaches, from seed funding to later-stage investments. Understanding the intricacies of these strategies is crucial for successful venture capital operations. A deep dive into market trends and potential investment opportunities is essential for maximizing returns and minimizing risk.

Private investment in venture capital often involves significant due diligence. Thorough research and analysis of a startup's business model, market position, and management team are critical for informed investment decisions. This process requires a keen understanding of the startup ecosystem and the ability to identify promising ventures with high growth potential.

Attracting and Evaluating Potential Investments

A key element of leveraging private investment involves attracting and evaluating potential investments. This process necessitates a comprehensive understanding of the venture capital landscape. Firms must effectively communicate their investment strategy and value proposition to potential entrepreneurs and startups.

Thorough due diligence is paramount. This involves evaluating the financial projections, market analysis, and management team of each prospective investment. The goal is to identify ventures with high growth potential and a strong likelihood of success.

Managing Portfolio Companies

After investing, managing portfolio companies is critical to maximizing returns. This involves providing mentorship, guidance, and support to entrepreneurs. Effective management strategies often include access to networks, industry expertise, and financial resources.

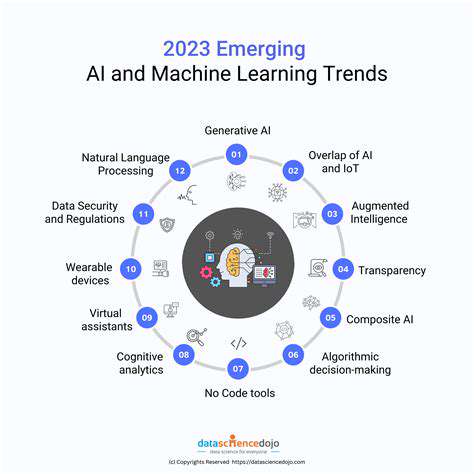

Understanding Market Trends and Opportunities

Staying abreast of market trends and identifying potential investment opportunities are vital for success in private investment. This requires continuous monitoring of industry developments, technological advancements, and changing consumer preferences. Recognizing emerging trends early can provide significant advantages.

A strong understanding of market dynamics and economic indicators allows for informed investment decisions and risk mitigation strategies.

Exit Strategies and Portfolio Diversification

Successful private investment strategies often include a well-defined exit strategy. This could involve an IPO (Initial Public Offering), acquisition, or other methods for realizing returns on investment. Diversification of the investment portfolio is also a crucial aspect.

Risk Management and Mitigation

Risk management and mitigation are essential components of any private investment strategy. Thorough due diligence and a clear understanding of market risks are crucial. Effective risk management strategies help to minimize potential losses and maximize returns. This includes careful consideration of economic downturns and industry-specific challenges.

Diversification across different investment opportunities, sectors, and geographies can help to mitigate overall portfolio risk.

Regulatory Compliance and Legal Considerations

Navigating the regulatory landscape and legal considerations is paramount for private investment success. Adherence to all relevant laws and regulations is essential to avoid legal issues and maintain ethical business practices. Understanding the complexities of investment laws and regulations is critical.

Compliance with SEC (Securities and Exchange Commission) regulations and other relevant jurisdictions is mandatory for investment firms.

Partnerships and Collaborations: A Synergistic Approach to EdTech Funding

Strategic Alliances for Growth

Partnerships in the EdTech sector are crucial for driving innovation and scaling impact. Strategic alliances with educational institutions, government agencies, and private companies can provide access to new markets, diverse expertise, and valuable resources. This collaborative approach fosters a synergistic environment where each partner leverages their unique strengths to achieve shared goals, ultimately benefiting students and educators alike. Building strong relationships built on mutual trust and shared vision is key to long-term success.

These alliances often involve knowledge sharing, joint research initiatives, and the development of innovative educational programs. By combining resources and expertise, partners can overcome challenges and achieve greater impact on the field of education.

Leveraging Private Sector Investments

Private sector investment plays a vital role in driving EdTech innovation. Partnerships with venture capital firms, angel investors, and corporations can provide the necessary capital for research and development, product development, and scaling operations. These partnerships are critical for bringing new technologies and educational tools to market, thereby improving the quality and accessibility of education for all.

Successful partnerships often involve clear agreements on investment terms, intellectual property rights, and future growth strategies. Transparency and open communication are essential to building trust and ensuring a mutually beneficial relationship.

Public-Private Partnerships: Bridging the Gap

Public-private partnerships are becoming increasingly important in EdTech. Collaborations between government agencies and the private sector can create programs that address specific educational needs and provide access to education for underserved populations. These partnerships can leverage public resources to support innovative educational initiatives, while private sector expertise and resources facilitate implementation and scale.

Such partnerships often focus on projects related to digital literacy, teacher training, and access to technology in rural areas. A successful public-private partnership can create a lasting impact on the educational landscape.

Community Engagement and Philanthropy

Engaging with local communities and leveraging philanthropic support is another important aspect of EdTech funding. Partnerships with community organizations can provide valuable insights into local needs and preferences, leading to the development of more relevant and effective educational tools. Philanthropic contributions can supplement funding from other sources, enabling EdTech companies to expand their reach and impact.

These partnerships often involve community outreach programs, workshops, and mentorship opportunities that empower students and teachers. By fostering a sense of community, partnerships can ensure that educational technologies are effectively integrated into daily practices.

Educational Institution Collaborations: Integrating Technology

Collaborating with educational institutions is vital for integrating EdTech into the curriculum and ensuring its effective use in classrooms. Partnerships with schools, colleges, and universities can provide valuable feedback on the usability and effectiveness of new technologies, leading to continuous improvement and refinement. These partnerships can also help to identify specific needs and areas for improvement in the educational technology landscape.

International Partnerships: Expanding Reach

International partnerships are essential for expanding the reach and impact of EdTech solutions. Collaborations with educational institutions and organizations in other countries can facilitate the exchange of knowledge, best practices, and innovative approaches to education. These partnerships can support the development of globally relevant educational tools and promote international understanding.

By working with international partners, EdTech companies can gain access to diverse perspectives, expertise, and funding opportunities, ultimately contributing to a more equitable and effective global educational system.

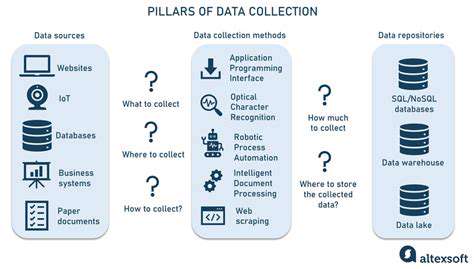

Data and Research Partnerships: Driving Innovation

Data and research partnerships play a critical role in evaluating the effectiveness of EdTech solutions and driving innovation in the field. Collaborations with research institutions and educational data analysts can provide valuable insights into student learning outcomes, teacher effectiveness, and the impact of different technologies. This data-driven approach enables EdTech companies to continuously improve their products and services, leading to more impactful and effective educational experiences.

Robust research partnerships can provide the evidence needed to demonstrate the value and efficacy of EdTech solutions, making it easier to secure additional funding and support for future development and implementation.

Supporting EdTech Adoption in Schools: Funding Strategies for Educational Institutions

Enhancing Teacher Training Programs

Effective teacher training is crucial for successful EdTech integration. Comprehensive programs should not only introduce teachers to new technologies but also equip them with the skills to effectively implement them in their classrooms. This includes hands-on experience, opportunities for collaboration with colleagues, and ongoing support. Providing ongoing professional development, such as workshops and online courses, is essential to maintain and refine teacher skills, ensuring they can adapt to evolving EdTech tools and strategies. These programs should be tailored to specific subject areas and grade levels, recognizing the unique needs of different teaching contexts.

Training should also focus on pedagogical approaches that leverage EdTech. Teachers must understand how to integrate technology seamlessly into existing lesson plans and learning objectives, not as a replacement but as a tool to enhance student engagement and learning outcomes. This involves exploring different pedagogical models, such as project-based learning and inquiry-based learning, to maximize the potential of technology to foster critical thinking and problem-solving skills.

Fostering a Supportive School Environment

A supportive school environment is essential for encouraging the successful adoption of EdTech. This includes providing adequate resources and infrastructure, such as reliable internet access and up-to-date technology equipment. Schools should invest in creating a culture that encourages innovation and experimentation. This includes establishing clear guidelines and policies for using technology responsibly and safely while also empowering teachers to take the lead in exploring new educational approaches.

Encouraging collaboration between teachers and providing opportunities for peer-to-peer learning can greatly enhance the adoption process. This approach fosters a sense of community and shared responsibility, creating a culture of continuous improvement and innovation within the school. Creating a space for teachers to share ideas and experiences can lead to valuable insights and strategies for effectively using technology in the classroom.

Addressing Equity and Access Concerns

Ensuring equitable access to EdTech is paramount for all students. Digital divides can significantly hinder the benefits of EdTech, leading to disparities in learning outcomes. Schools must actively address these challenges by providing equal access to technology and internet connectivity for all students, regardless of their socioeconomic background or location. This might involve providing devices for students who lack them, establishing robust internet access in underserved areas, and offering digital literacy training to students and families.

Furthermore, educators need to be mindful of the diverse learning needs of students. Tailoring EdTech tools and strategies to meet the specific learning styles and needs of individual students is essential for maximizing the effectiveness of the technology. This can include providing alternative formats for learning materials and offering support for students who may need additional assistance with technology use.

Developing Clear Policies and Procedures

Well-defined policies and procedures are necessary for effective EdTech implementation. These policies should address issues such as data privacy, responsible technology use, and copyright considerations. Schools should develop clear guidelines for student and teacher use of technology, ensuring that it is used ethically and responsibly. Having a clear and accessible policy document can help create a transparent and consistent approach across the school.

Establishing procedures for troubleshooting technical issues and providing ongoing support for teachers and students is critical. This proactive approach helps to minimize disruptions and ensure that technology is used effectively and efficiently. Having a dedicated support team or access to online resources can help mitigate technical problems and provide timely assistance, ensuring a smooth transition for everyone.

Read more about Funding EdTech Innovation: Opportunities for Startups and Schools

Hot Recommendations

- The Gamified Parent Teacher Conference: Engaging Stakeholders

- Gamification in Education: Making Learning Irresistibly Fun

- The Future of School Libraries: AI for Personalized Recommendations

- EdTech and the Future of Creative Industries

- Empowering Student Choice: The Core of Personalized Learning

- Building Community in a Hybrid Learning Setting

- VR for Special Education: Tailored Immersive Experiences

- Measuring the True Value of EdTech: Beyond Adoption Rates

- Addressing Digital Divide in AI Educational Access

- Preparing the Workforce for AI Integration in Their Careers