The Economic Benefits of Immersive Training Simulations

Return on Investment (ROI) and Measurable Outcomes

Understanding Return on Investment (ROI)

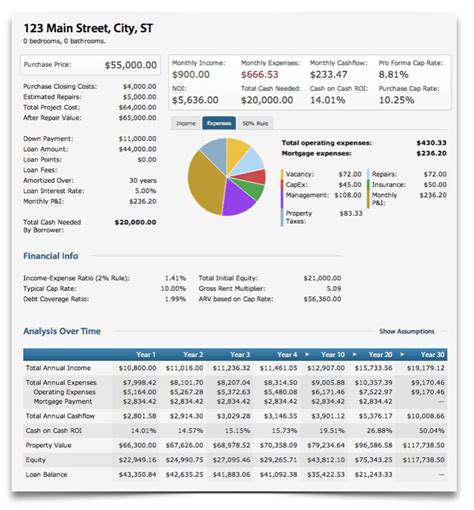

Return on Investment (ROI) is a crucial financial metric used to evaluate the profitability of an investment. It measures the gain or loss generated on an investment relative to the cost of the investment. Understanding ROI is vital for making informed investment decisions, whether it's a business venture, a stock purchase, or a personal financial goal.

A high ROI indicates a successful investment, while a low or negative ROI suggests potential problems or a poor investment choice. Calculating ROI helps quantify the effectiveness of various strategies and allocate resources efficiently.

Calculating ROI: A Simple Formula

The ROI formula is relatively straightforward: (Net Profit / Cost of Investment) * 100. Net profit represents the total revenue generated from the investment minus any associated costs. The cost of investment encompasses all initial expenditures, including setup, materials, labor, and other associated expenses.

For example, if an investment costs $1,000 and generates a profit of $300, the ROI would be calculated as (300 / 1000) * 100 = 30%. This signifies a 30% return on the initial investment.

Factors Influencing ROI

Several factors influence the return on investment for any given venture. Market conditions, economic trends, and competitive landscapes are among the external factors that can significantly impact the final outcome. Internal factors, such as management expertise, operational efficiency, and marketing strategies, also play a pivotal role.

Proper planning and risk assessment are crucial to maximizing potential returns and mitigating potential losses. A comprehensive understanding of both internal and external factors is essential for achieving a satisfactory ROI.

ROI in Different Investment Areas

ROI calculations apply across a wide range of investments. From stocks and bonds to real estate and business ventures, the concept of ROI provides a standardized method to evaluate the profitability of various options. Analyzing the historical performance of investments, taking into account market fluctuations and risk tolerance, can help in making informed decisions.

Measuring ROI Beyond Financial Gains

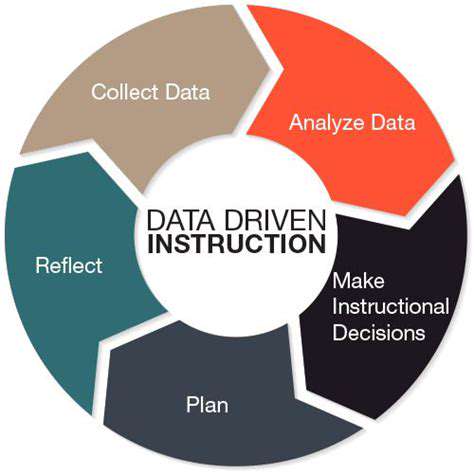

While financial returns are often the primary focus, ROI can also encompass non-monetary benefits. For example, a company investing in employee training programs might see an increase in employee engagement and productivity as a return, which can have a positive impact on overall business performance.

Measuring the intangible aspects of ROI, such as improved customer satisfaction, brand reputation, or increased market share, is just as important as quantifying financial gains. This holistic view of ROI provides a more comprehensive understanding of the investment's overall impact.

Optimizing ROI: Strategies and Best Practices

Maximizing ROI involves a multifaceted approach that requires careful consideration of various factors. Strategic planning, market research, and competitor analysis are critical elements in developing effective strategies for achieving a higher ROI. Efficient resource allocation and cost management are also vital for maximizing returns.

Implementing effective strategies, continuously monitoring progress, and adapting to changing market conditions are essential for maintaining a high ROI over the long term. Regular evaluation and adjustments based on performance data help optimize the investment's potential returns.

Read more about The Economic Benefits of Immersive Training Simulations

Hot Recommendations

- The Gamified Parent Teacher Conference: Engaging Stakeholders

- Gamification in Education: Making Learning Irresistibly Fun

- The Future of School Libraries: AI for Personalized Recommendations

- EdTech and the Future of Creative Industries

- Empowering Student Choice: The Core of Personalized Learning

- Building Community in a Hybrid Learning Setting

- VR for Special Education: Tailored Immersive Experiences

- Measuring the True Value of EdTech: Beyond Adoption Rates

- Addressing Digital Divide in AI Educational Access

- Preparing the Workforce for AI Integration in Their Careers