The Future of Digital Portfolios: Mobile and Interactive

Data-Driven Portfolio Optimization: Measuring Success

Understanding Key Metrics

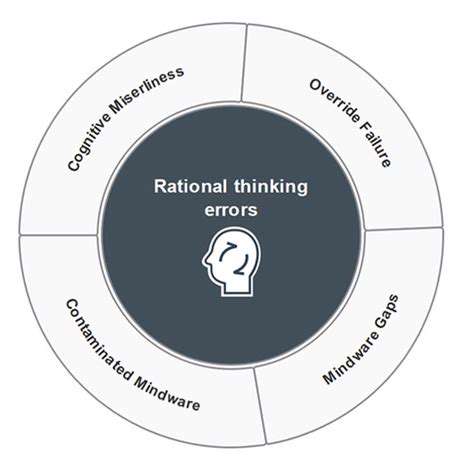

To truly optimize a portfolio using data, it's essential to focus on the right metrics. While ROI is a critical factor, it's not the only one. Investors should also evaluate risk-adjusted returns, volatility, diversification, and how well the portfolio aligns with their financial objectives. Analyzing historical performance and market trends, along with predictive modeling, can reveal valuable insights into future performance.

Qualitative factors are just as important as quantitative data. Does the portfolio match the investor's risk tolerance? Is there enough diversification to reduce risk? Combining these qualitative assessments with hard data provides a complete view of the portfolio's health.

Implementing Algorithmic Strategies

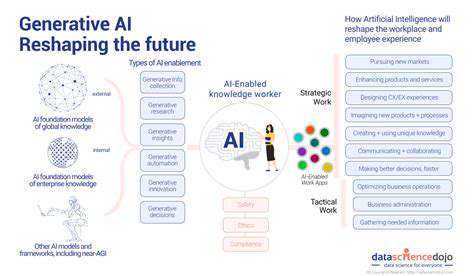

Advanced algorithms can process massive datasets to determine the best portfolio allocations. These systems take into account real-time market conditions, economic forecasts, and investor preferences to make dynamic adjustments. This automation enhances efficiency and effectiveness, leading to better returns with less manual effort.

However, algorithmic strategies require careful oversight. Backtesting and continuous monitoring are necessary to prevent bias and ensure the algorithms perform as expected in live markets.

Utilizing Machine Learning Techniques

Machine learning (ML) models can predict market trends and refine portfolio strategies with high precision. By examining historical data, ML identifies patterns that traditional methods might overlook. This results in more sophisticated investment approaches, helping investors seize emerging opportunities and adapt to market shifts.

Adapting to Evolving Market Conditions

Financial markets are always changing, and portfolios must evolve with them. Regularly updating the data used for optimization ensures strategies stay relevant. Monitoring economic indicators, market sentiment, and new developments is crucial. Flexibility is key to maintaining a resilient portfolio.

Rebalancing based on trends and volatility helps maximize returns and minimize losses. This dynamic approach keeps the portfolio aligned with the investor's goals and risk tolerance over time.

The Future is Personalization and Integration

Personalized Learning Experiences

Digital portfolios are no longer just static collections of work. The future lies in personalized learning experiences, where portfolios adapt to individual student needs. Imagine a portfolio that suggests resources and projects based on a student's progress, strengths, and areas for improvement. This tailored approach boosts engagement and learning outcomes.

Teachers gain insights into student learning styles, while students can focus on areas needing development. It’s a win-win for both.

Integrated Assessment and Feedback

Digital portfolios should seamlessly incorporate assessment and feedback. Self-evaluations, peer reviews, and teacher comments can all reside within the portfolio. This centralized system promotes transparency and continuous growth.

Seamless Collaboration and Communication

Future portfolios will enhance collaboration. Students can share work, receive feedback, and discuss ideas with peers and mentors—all within the same platform. This fosters a connected and supportive learning environment.

Enhanced Accessibility and Inclusivity

Accessibility must be a priority. Portfolios should include features like adjustable fonts, alt text for images, and audio-visual options to accommodate all learners.

Advanced Analytics and Reporting

Data-driven insights are transforming education. Portfolios with advanced analytics help teachers and students track progress, identify strengths, and pinpoint areas for improvement. These insights guide personalized learning strategies.

Mobile-First and Cloud-Based Solutions

The future of portfolios is mobile and cloud-based. Students and teachers can access and manage their work from anywhere. Cloud platforms enable collaboration, ensure security, and provide flexibility for learning on the go.

Read more about The Future of Digital Portfolios: Mobile and Interactive

Hot Recommendations

- The Gamified Parent Teacher Conference: Engaging Stakeholders

- Gamification in Education: Making Learning Irresistibly Fun

- The Future of School Libraries: AI for Personalized Recommendations

- EdTech and the Future of Creative Industries

- Empowering Student Choice: The Core of Personalized Learning

- Building Community in a Hybrid Learning Setting

- VR for Special Education: Tailored Immersive Experiences

- Measuring the True Value of EdTech: Beyond Adoption Rates

- Addressing Digital Divide in AI Educational Access

- Preparing the Workforce for AI Integration in Their Careers