Mobile Learning for Financial Literacy

Mobile budgeting apps have fundamentally changed how people manage their finances. These apps offer a convenient and accessible way to track income and expenses, providing users with real-time insights into their spending habits. This accessibility is particularly valuable for individuals who may struggle with traditional budgeting methods. It streamlines the process, enabling users to make informed financial decisions on the go.

With a wealth of features ranging from expense categorization to goal setting, these apps empower users to take control of their financial well-being. The integration of notifications and reminders further enhances the user experience, ensuring timely financial management.

The Power of Real-Time Tracking and Analysis

One of the key advantages of mobile budgeting apps is the ability to track spending in real-time. This real-time data allows users to immediately identify areas where they might be overspending and make necessary adjustments. The data visualizations within these apps make it easy to spot trends and patterns in spending, offering valuable insights for better financial decision-making. Visualizing expenses in charts and graphs allows a clear picture of financial health.

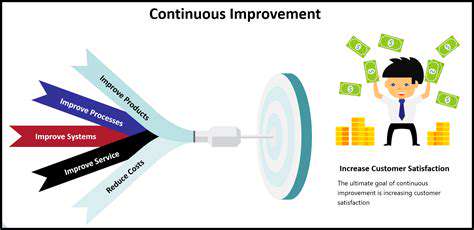

This continuous monitoring empowers users to understand their spending habits better. A good budgeting app can provide tailored recommendations and insights based on the user's spending patterns, fostering a proactive approach to financial management. This proactive approach is critical for long-term financial success.

Personalized Budgeting Strategies and Goals

Mobile budgeting apps often allow users to personalize their budgeting strategies. This personalization caters to individual needs and preferences, making the budgeting process more engaging and effective. Users can set specific financial goals, such as saving for a down payment on a house or paying off debt, and the app can provide tools and reminders to help achieve those goals. This tailored approach is key to motivating users and fostering a sense of accomplishment.

Accessibility and Convenience: On-the-Go Financial Management

The convenience of mobile budgeting apps is unparalleled. Users can access their financial data and manage their budgets from anywhere, anytime, using their smartphones. This accessibility is a game-changer for busy individuals who may not have the time or resources for traditional budgeting methods. The constant availability of financial information empowers users to make informed decisions on the fly. This flexibility promotes a proactive and responsive approach to personal finance management.

Ceramic coatings for wheels provide a superior layer of protection against the harsh elements of the road, significantly extending the lifespan of your rims. These coatings form a robust barrier against road debris, salt spray, and UV radiation, preventing corrosion, scratches, and fading. This superior protection translates to a significant decrease in maintenance needs, saving you time and money in the long run. The hard, durable nature of the ceramic coating ensures your wheels retain their pristine appearance, even after years of use.

Mobile Learning: Accessibility and Personalization for Financial Success

Mobile Learning: A Gateway to Financial Literacy

Mobile learning platforms are revolutionizing the way people access and engage with financial education. This innovative approach allows individuals to learn at their own pace and convenience, making financial literacy more accessible than ever before. The portability of mobile devices empowers learners to revisit concepts, practice skills, and apply knowledge in real-world scenarios, fostering a deeper understanding of financial principles and strategies.

With readily available apps and resources, users can overcome geographical limitations and gain access to diverse educational materials. This increased accessibility creates a more inclusive learning environment, benefiting individuals from various backgrounds and socioeconomic situations.

Personalized Learning Journeys for Financial Empowerment

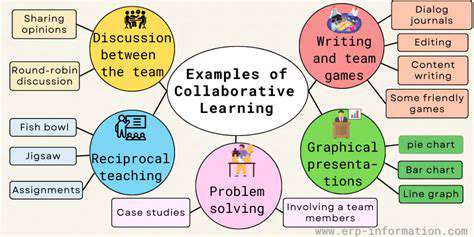

Mobile learning excels in personalizing the learning experience. By adapting to individual learning styles and paces, these platforms cater to diverse needs and preferences. Adaptive learning algorithms analyze user progress and tailor content recommendations, ensuring that learners receive the most relevant and effective instruction.

Interactive exercises, quizzes, and simulations further enhance engagement and understanding. These personalized features allow learners to focus on areas where they need more support and reinforce concepts they grasp readily.

Accessibility Features for Inclusive Learning

Mobile learning platforms are designed with accessibility in mind. Features like text-to-speech, adjustable font sizes, and alternative input methods cater to learners with disabilities. These thoughtful design choices ensure that everyone, regardless of their abilities, can access and benefit from the learning content.

Furthermore, mobile devices often provide a familiar interface, making learning more intuitive and user-friendly for diverse populations. This inclusivity is crucial in promoting equitable access to financial knowledge.

Gamification for Enhanced Engagement and Retention

Integrating gamification elements into mobile learning platforms can significantly improve engagement and retention. Points, badges, leaderboards, and interactive challenges create a motivating and enjoyable learning environment. This approach transforms learning from a passive activity to an active and rewarding experience.

Practical Application of Knowledge Through Mobile Tools

Mobile learning's strength lies in its ability to connect theoretical knowledge to practical application. Mobile banking apps, budgeting tools, and investment platforms are readily available, enabling learners to immediately apply the concepts they've learned. This hands-on approach solidifies understanding and fosters a deeper connection to financial management strategies.

Bridging the Knowledge Gap and Promoting Financial Well-being

By providing accessible and personalized financial education through mobile platforms, we can effectively bridge the knowledge gap and promote financial well-being. Individuals equipped with the necessary skills and knowledge are empowered to make informed financial decisions, manage their resources effectively, and achieve long-term financial success. This translates to a more financially secure and stable future for individuals and communities as a whole.